Driving Carbon Removal Forward: Continued Growth, Pathway Insights, and Pricing Perspectives

by Carbonx Climate | Jul 11, 2023 | Articles

Analyzing Funding Trends, Commercialization Progress, and Price Variations

Three months ago, we launched the Carbonx Data Initiative with the goal of improving carbon dioxide removal (CDR) market data transparency and encouraging a better overall understanding of the carbon removal space.

Taking a step back, what is particularly impressive is the evolution of the industry we have seen from 2008 to 2023. The number of companies offering permanent CDR projects surged from 9 to an impressive 116 within 15 years.

Even more remarkable is the staggering growth over the span of a mere four years. From 2019 to 2022, an average of 17 new companies per year emerged, collectively contributing to half of the present-day CDR landscape.

Bio-Base Projects Take the Lead: Unveiling the Diversity of the CDR Technology Landscape

Looking at the distribution of CDR projects across different removal pathways, you will notice the largest category is ‘bio-based solutions with long-term storage’, including technologies such as biochar, bio-oil or BECCS: it accounts for 50% of the total number of CDR companies.

Compared to some emerging and nascent pathways, bio-based solutions have undergone significant R&D and real-world implementation. This is because bio-based carbon sequestration has a longer history: the concept of using charcoal-like substances for agricultural purposes dates back centuries, and biochar has undergone numerous field trials over the years. Its properties, production methods, and applications have been studied in various contexts, including agriculture, environmental remediation, and carbon sequestration. It now has established supply chains and market presence, as well as developed standards, guidelines, and certifications to ensure quality control. This makes it a mature and regulated industry, with costs allowing it to be commercially available at scale.

Let’s take a closer look at the distribution of feedstock types for biochar projects:

- Wood, accounting for 51% of the biochar projects, emerges as the most commonly used feedstock as it is abundant and draws upon established practices. Moreover, wood possesses favorable carbon-to-nitrogen ratios, which contribute to the stability and quality of the resulting biochar.

- Agricultural waste constitutes 42% of the feedstock distribution within biochar projects. Agricultural waste materials encompass a wide range of residues generated from farming practices, such as crop residues, straw, husks, or stalks. These feedstocks offer an attractive option for biochar production as they serve the dual purpose of waste management and carbon sequestration.

- The remaining portion of the feedstock distribution is allocated to municipal waste, which encompasses various organic waste materials generated from households, commercial activities, or urban centers, which offers the potential to address waste management challenges while simultaneously producing a valuable carbon-rich product.

Outside of bio-based solutions with long-term storage, it is important to note that all CDR technologies continue to evolve, and ongoing research and innovation are essential for further enhancing their effectiveness and scalability.

In second place, we find Direct Air Capture (DAC) as a prominent CDR pathway, constituting 25% of the projects. DAC technologies aim to directly capture carbon dioxide from ambient air, offering the advantage of scalability.

- 45% of DAC projects have adopted solid sorbent technology as their preferred approach for capturing and separating carbon dioxide. Solid sorbents offer several advantages in the DAC process, including high selectivity for CO2, efficient adsorption properties, and ease of regeneration for subsequent carbon release.

- 23% have adopted liquid sorbent technology, such as solvents, absorbent solutions, or specialized chemical mixtures

Taking the third spot is enhanced weathering, accounting for 14% of CDR projects. This pathway explores harnessing natural geological processes to accelerate the absorption of carbon dioxide through the weathering of certain rocks.

- Out of the 14 enhanced weathering projects tracked, we know the utilized feedstocks of 11 of them.

- Basalt demonstrates the highest representation (38% of the projects). Basalt, a common volcanic rock, possesses inherent properties that facilitate the natural weathering process and subsequent carbon dioxide absorption.

- Olivine and mine tailings contribute 23% and 15% of the projects, respectively. Olivine, a magnesium-iron silicate mineral, has gained attention for its high reactivity and potential to accelerate carbon dioxide capture through weathering. On the other hand, mine tailings, a byproduct of mining operations, offer a resourceful avenue for carbon dioxide removal by utilizing waste materials effectively.

Ocean alkalinity is in fourth place, securing 7% of CDR projects. includes Electrochemical Ocean Alkalinity Enhancement and Mineral Ocean Alkalinity Enhancement.

- Electrochemical Ocean Alkalinity Enhancement : by electrochemical separation (also called “Direct Ocean Capture”), which removes acidity from seawater and returns a more basic solution to enhance ocean alkalinity.

- Mineral Ocean Alkalinity Enhancement: by adding rocks to the ocean which dissolve to enhance alkalinity.

These pathways, along with the advancements in synthetic biology (representing 3% of projects), collectively demonstrate the diversity and innovation within the CDR field. Continued research, development, and collaboration in these emerging pathways hold the potential to shape the future of effective and sustainable carbon dioxide removal.

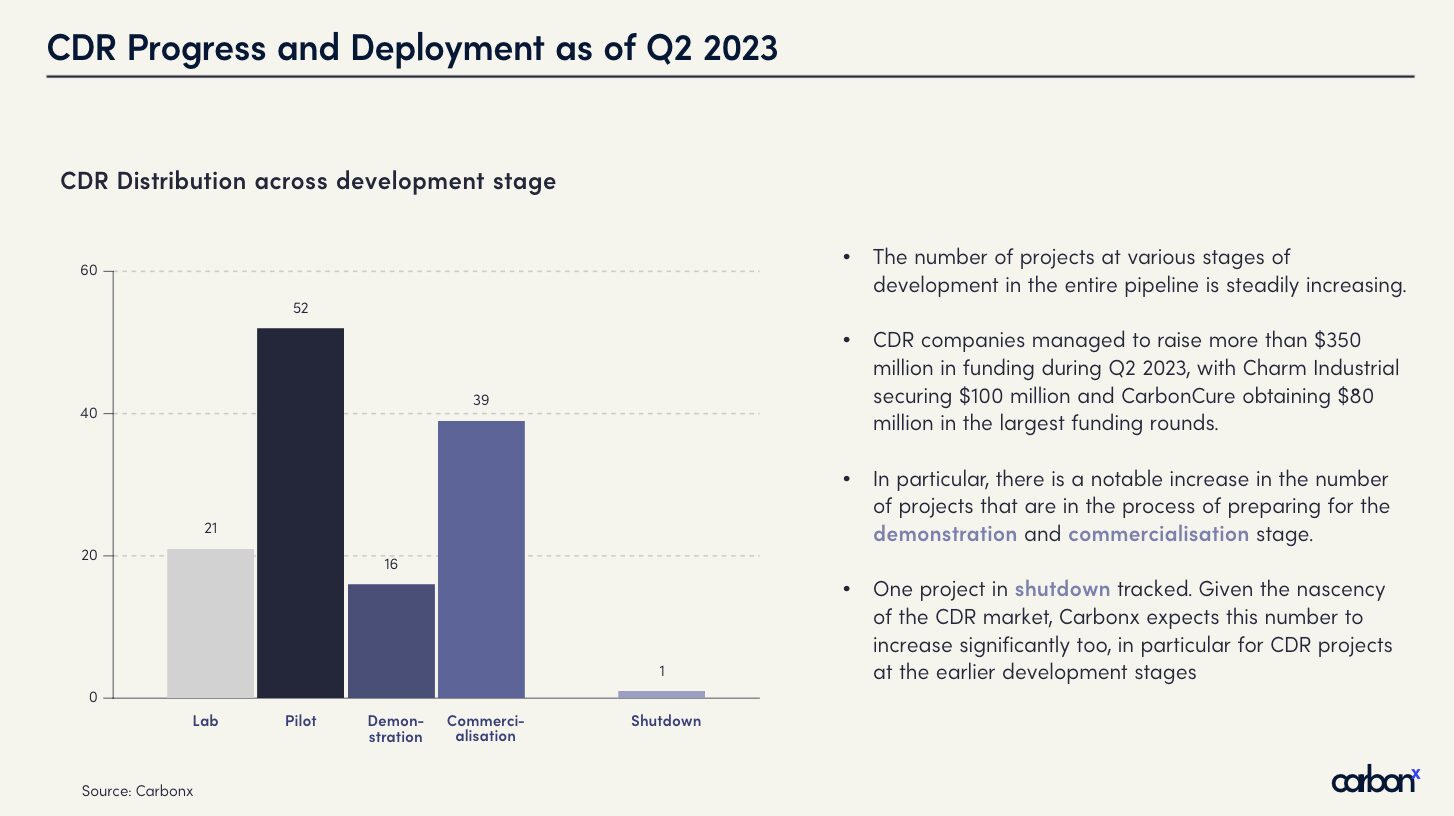

Scaling Carbon Solutions: One-Third of CDR Projects Ready for Commercialization

The current landscape of CDR projects reveals that the market is more advanced than initially anticipated. While early-stage projects lay the foundation for innovative solutions, projects in the commercialisation stage, particularly in the biochar sector, highlight the market’s readiness for widespread adoption.

The data we collected highlights that 14% CDR projects are in the Lab stage, signifying the initial phase of research and testing in controlled laboratory environments. Additionally, 43% projects have progressed to the Pilot stage, where they undergo real-world testing on a larger scale. These projects are primarily DAC, ocean-based removals, and mineralisation projects.

10% of the projects we track then made it to the demonstration stage. More interestingly, our data reveals that a third of projects are in the commercialisation stage, indicating their readiness for large-scale deployment. Notably, the majority of these commercialisation-stage projects are primarily biochar projects, showcasing a more mature technology within that domain.

There exists a significant range of Technology Readiness Levels (TRLs) within different removal pathways, such as DAC, spanning from TRL 2 to 9. This wide variation is a testament to the diverse technological advancements within each individual pathway, showcasing the breadth of singular solutions driving progress in the CDR field. As expected, projects categorized under TRL 9 (actual system proven in operational environment) predominantly consist of bio-based initiatives.

Carbon Removal Hotspots: North America and the UK Take the Lead with Over Half of CDR Projects

Permanent carbon removal is taking place all over the world; however, there are “hot spots” where there is heightened activity. This can be due to favourable, local natural characteristics, supportive local policy, available funding, and interested talent pools. Among the countries leading the charge, the United States stands at the forefront, accounting for over a third (34%) of the total CDR projects. The United Kingdom secures the second position with an 11% share of CDR projects, followed by Canada contributing 8% of the global CDR project landscape.

DAC Takes the Funding Lead: $1.2 Billion Poured into Direct Air Capture for CDR Projects

The data we collected shows CDR companies have collectively received over $1.7 billion of funding through equity and grants since their inception.

Out of the total $1.7 billion invested in CDR projects, an impressive $1.2 billion has been allocated to DAC, showcasing the high level of confidence and support for this technology. Climeworks attracted the lion’s share of funding with $800 million of equity, including a $650m equity round in April 2022 with investors such as Partners Group and GIC.

Storage solutions secured the second-largest funding allocation, receiving $218 million. The investment in storage solutions such as Carbfix ($117m grant) highlights the importance of developing effective and reliable methods for long-term carbon storage, ensuring the sustainability and permanence of carbon removal efforts.

Bio-based solutions attracted $141 million in funding, reflecting the interest in leveraging organic materials to sequester carbon, but also showing the confidence in a technology which has already demonstrated its effectiveness in carbon removal endeavors. For instance, Brilliant Planet, which invented an innovative process enabling vast quantities of microalgae to grow in open-air pond-based systems on coastal desert land, secured $27m total of funding since its inception, including a $12m series A round in April 2022.

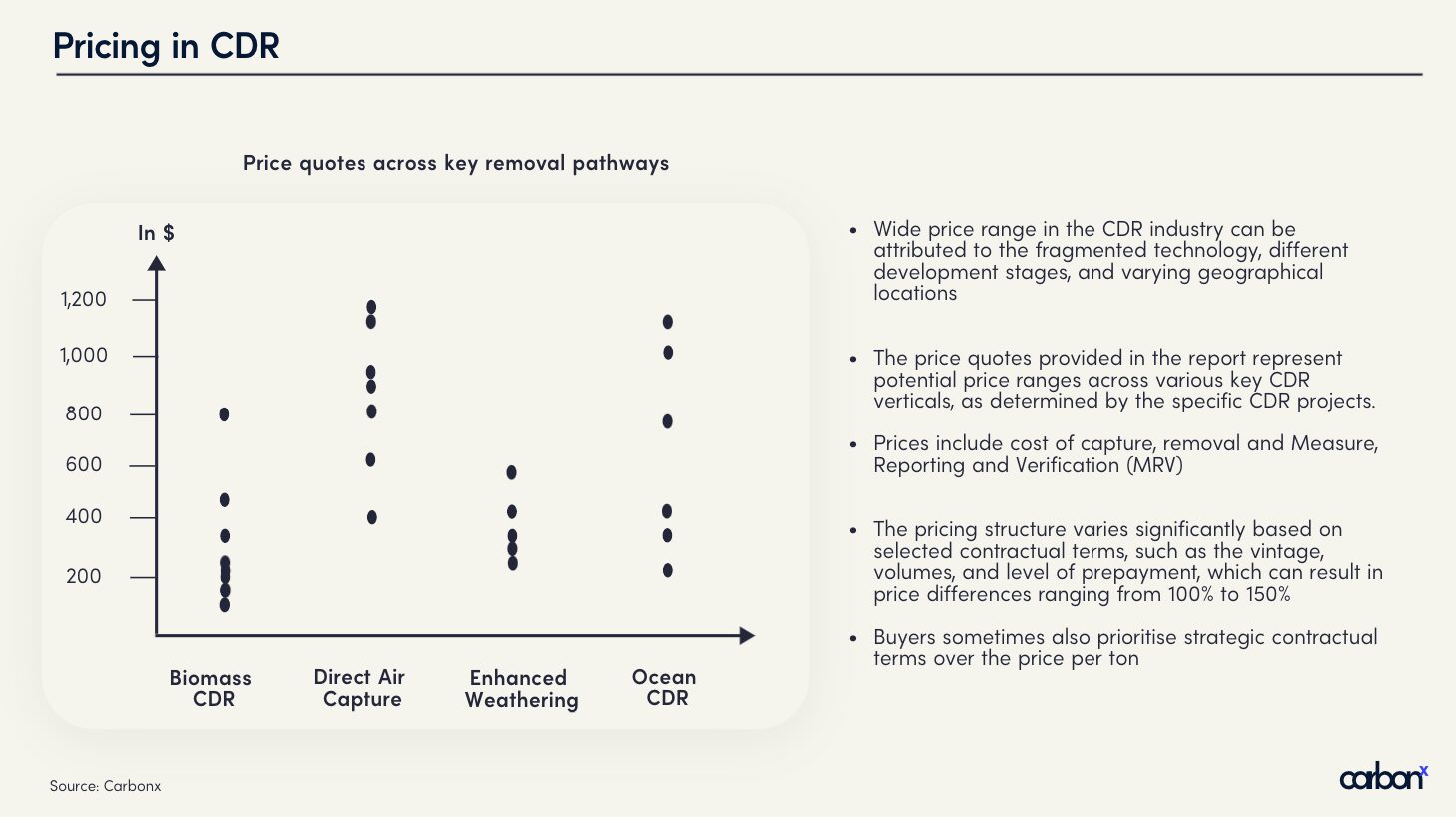

Price Variations in Carbon Removal Pathways

The prices we collected encompass both historical transactions for completed carbon removal and future carbon removal prices through offtake agreements. Although the full value and insights from the datasets will gradually emerge as we track price movements per pathway in successive years (e.g., 2023, 2024, 2025), it is still worthwhile to examine the trends within the current aggregated dataset. Despite the absence of specific time data points, analyzing the existing price data can provide valuable insights into the overall trends.

Note for 2nd graph: Each dot represents a price point within that removal category

Datapoints represent the prices from existing transaction (when available), and the price from earliest possible delivery (when no existing transaction with public price).

Vast price ranges currently exist across different carbon removal pathways and among projects within those pathways. The price per ton for CDR projects is influenced by two main factors :

- Firstly, the levelized cost of capture and storage plays a significant role in determining the overall price: this includes the expenses associated with capturing carbon dioxide and storing it effectively, as well as measuring & quantifying the carbon removal.

- Secondly, contractual terms such as order size, prepayment level, and delivery year also impact the pricing structure.

Significant pricing variations exist across different carbon removal pathways, highlighting the dynamic nature of the CDR landscape. This variability can be attributed to the varying degrees of project maturity within each pathway. For instance, when examining the DAC pathway, prices of the projects we track range from $350 to $2000+, which can be partially explained by comparing it to their Technology Readiness Levels which are ranging from 2 to 9.

Bio-based solutions and Enhanced Weathering stand out as the most cost-effective options within the realm of carbon removal. This can be attributed to the fact these technologies leverage natural processes and make use of abundant feedstocks / widely available rocks, making them a relatively inexpensive resource for carbon removal efforts.

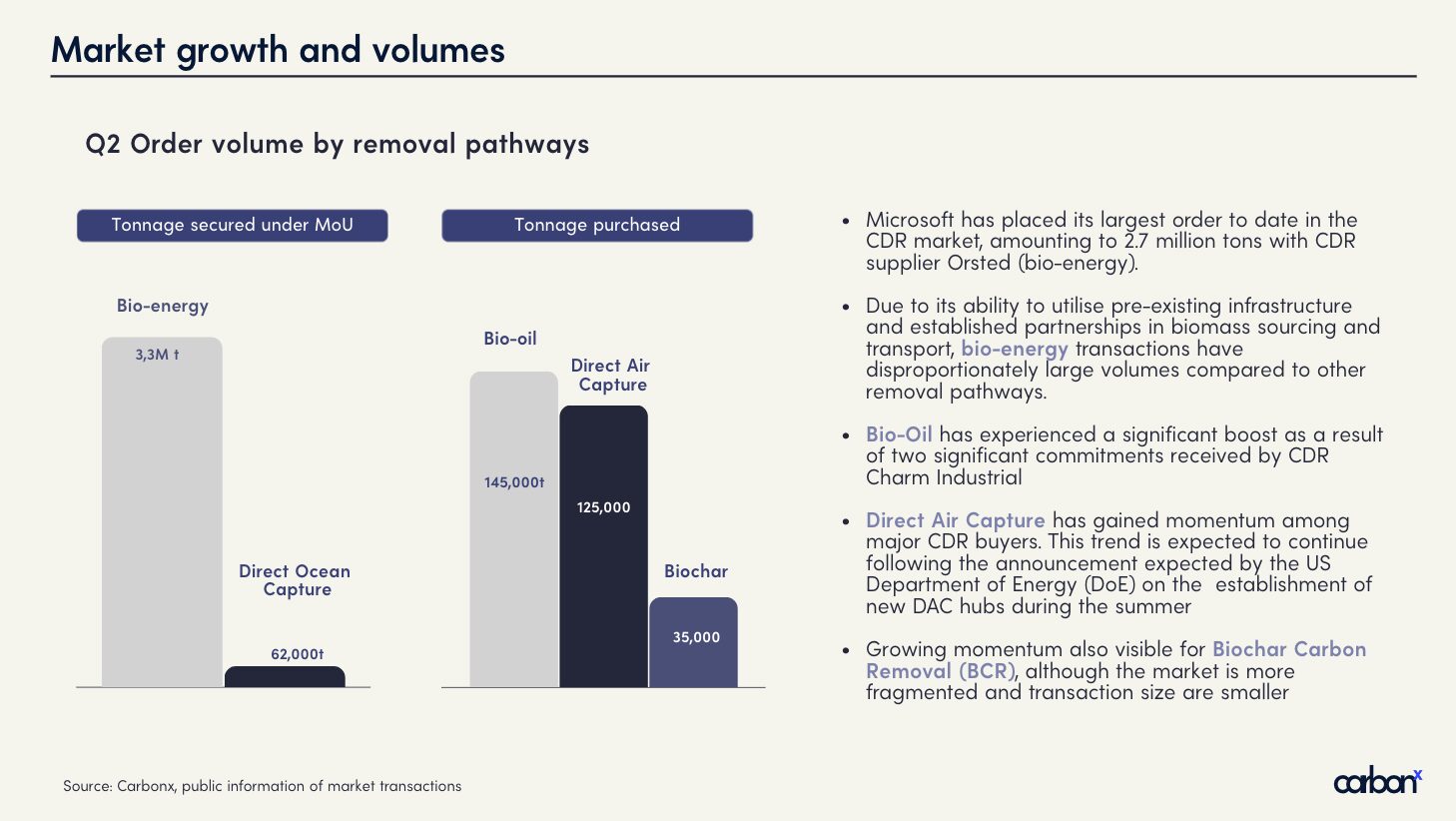

Q2 2023 CDR Market News Snapshot

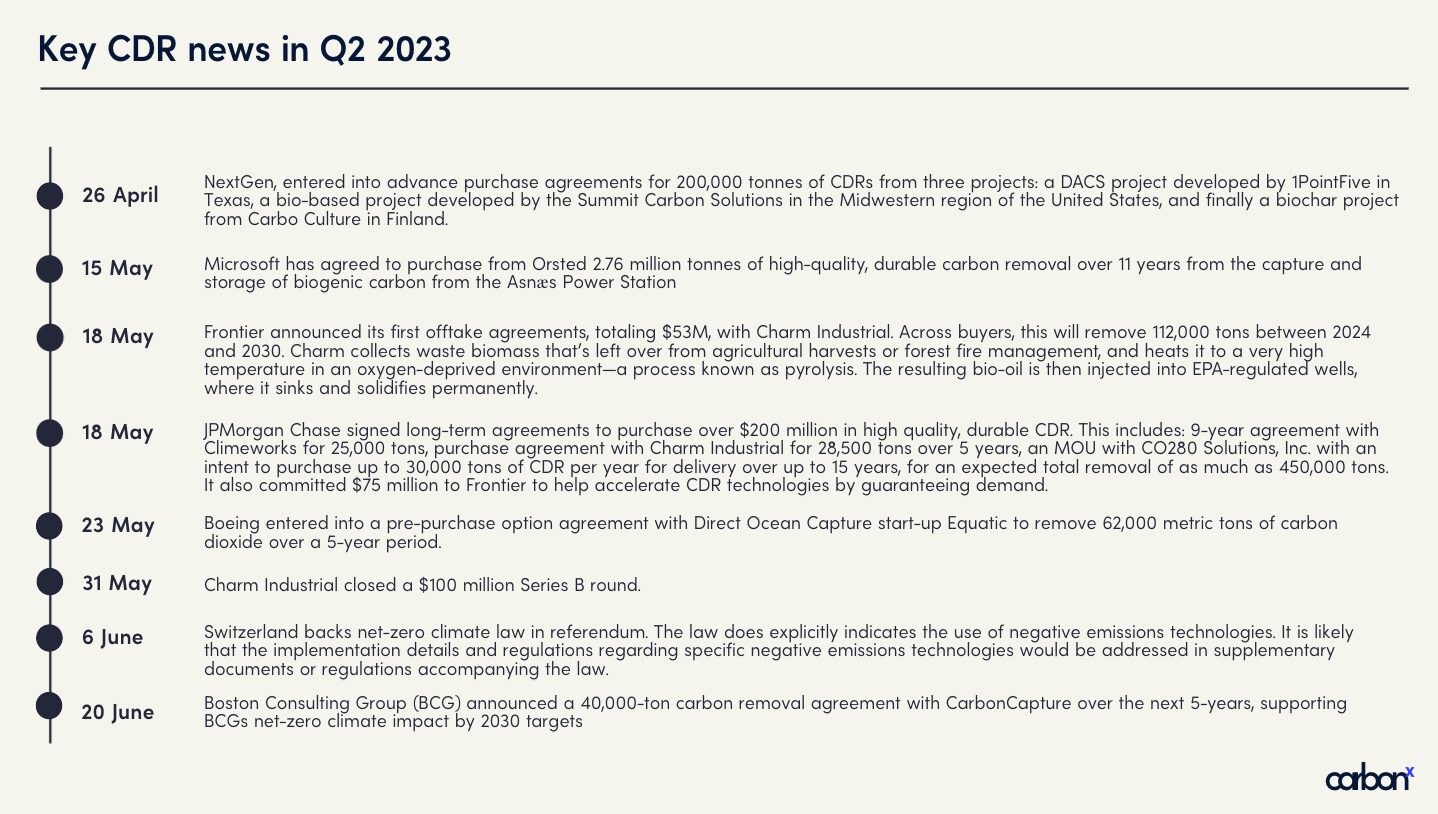

- 26 April: NextGen, a joint venture between South Pole and Mitsubishi Corporation, entered into advance purchase agreements for 200,000 tonnes of CDRs from three projects: a DACS project developed by 1PointFive in Texas, a bio-based project developed by the Summit Carbon Solutions in the Midwestern region of the United States, and finally a biochar project from Carbo Culture in Finland.

- 15 May: Microsoft has agreed to purchase from Ørsted 2.76 million tonnes of high-quality, durable carbon removal over 11 years from the capture and storage of biogenic carbon from the Asnæs Power Station

- 18 May: Frontier announced its first offtake agreements, totaling $53M, with Charm Industrial. Across buyers, this will remove 112,000 tons between 2024 and 2030. Charm collects waste biomass that’s left over from agricultural harvests or forest fire management, and heats it to a very high temperature in an oxygen-deprived environment—a process known as pyrolysis. The resulting bio-oil is then injected into EPA-regulated wells, where it sinks and solidifies permanently.

- 23 May: JPMorgan Chase signed long-term agreements to purchase over $200 million in high quality, durable CDR. This includes: 9-year agreement with Climeworks for 25,000 tons, purchase agreement with Charm Industrial for 28,500 tons over 5 years, an MOU with CO280 Solutions, Inc. with an intent to purchase up to 30,000 tons of CDR per year for delivery over up to 15 years, for an expected total removal of as much as 450,000 tons. It also committed $75 million to Frontier to help accelerate CDR technologies by guaranteeing demand.

- 31 May: Boeing entered into a pre-purchase option agreement with Direct Ocean Capture start-up Equatic to remove 62,000 metric tons of carbon dioxide over a 5-year period.

- 6 June: Charm Industrial closed a $100 million Series B round.

- 20 June: Switzerland backs net-zero climate law in referendum. The law does not explicitly confirm which specific types of negative emissions technologies are accepted or not. It is likely that the implementation details and regulations regarding specific negative emissions technologies would be addressed in supplementary documents or regulations accompanying the law.

- 21 June: Boston Consulting Group (BCG) announced a 40,000-ton carbon removal agreement with CarbonCapture over the next 5-years, supporting BCGs net-zero climate impact by 2030 targets.

Final remarks

The analysis of the current landscape of CDR projects reveals a remarkable surge in project launches in the span of just 4 years, reflecting the fast-growing ecosystem of CDR solutions. Among the different pathways, bio-based solutions, particularly those utilizing biochar, emerge as the leading category, showcasing their maturity and commercial availability.

The diversity and innovation within the CDR field, along with the readiness of one-third of projects for commercialization, highlight the market’s advanced state. Notably, North America and the UK lead in CDR project activity, and significant funding has been allocated to DAC projects. Pricing variations across different pathways underscore the dynamic nature of the CDR landscape, with bio-based solutions and enhanced weathering standing out as cost-effective options. Continued research, development, and collaboration in these pathways hold the potential to shape the future of effective and sustainable carbon dioxide removal.